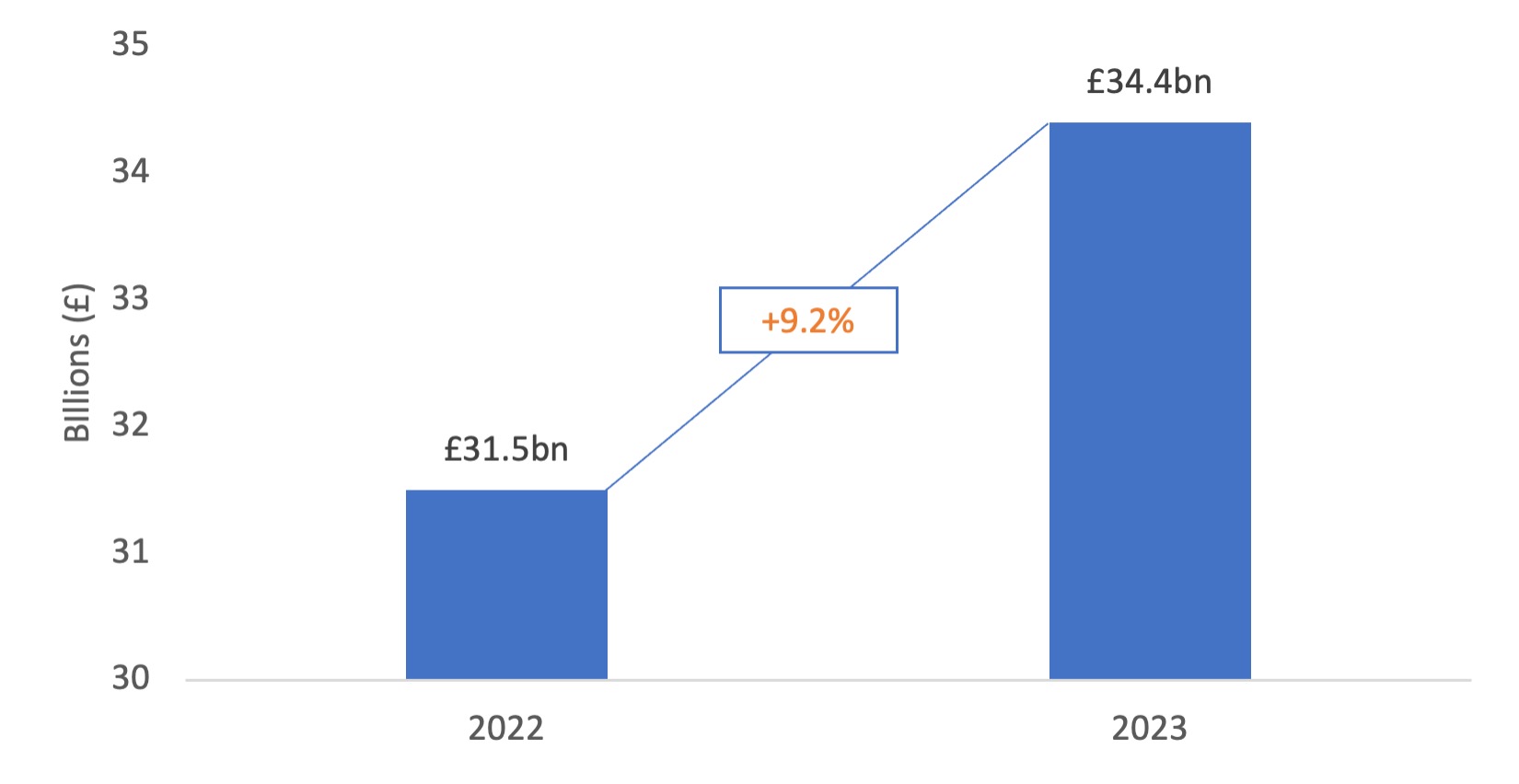

- In 2023, online retailers witnessed a staggering £34.4 billion loss in sales due to basket abandonment driven by delivery-related concerns.

- More than one in four attempted online purchases are now left abandoned by consumers, reflecting heightened caution among core spenders amidst financial pressures, and increased expectations from delivery services.

- Elevated interest rates have seen cost-of-living strains shift from the least affluent to engulf middle- to high-income groups, along with younger and middle-aged consumers, including recent home buyers on large mortgages and those with limited savings.

- Clothing & Footwear experienced the highest abandonment rate, with under-25s four times more likely to abandon purchases compared to over-65s.

- A significant 60% of middle- and high-income under-45s are willing to pay for premium shipping services, highlighting the potential for retailers to enhance value through delivery choice and flexibility.

20th May 2024: More than one in four online transactions are being abandoned at checkout, amounting to £34.4bn worth of lost opportunity in the past 12 months, according to new research from GFS and Retail Economics.

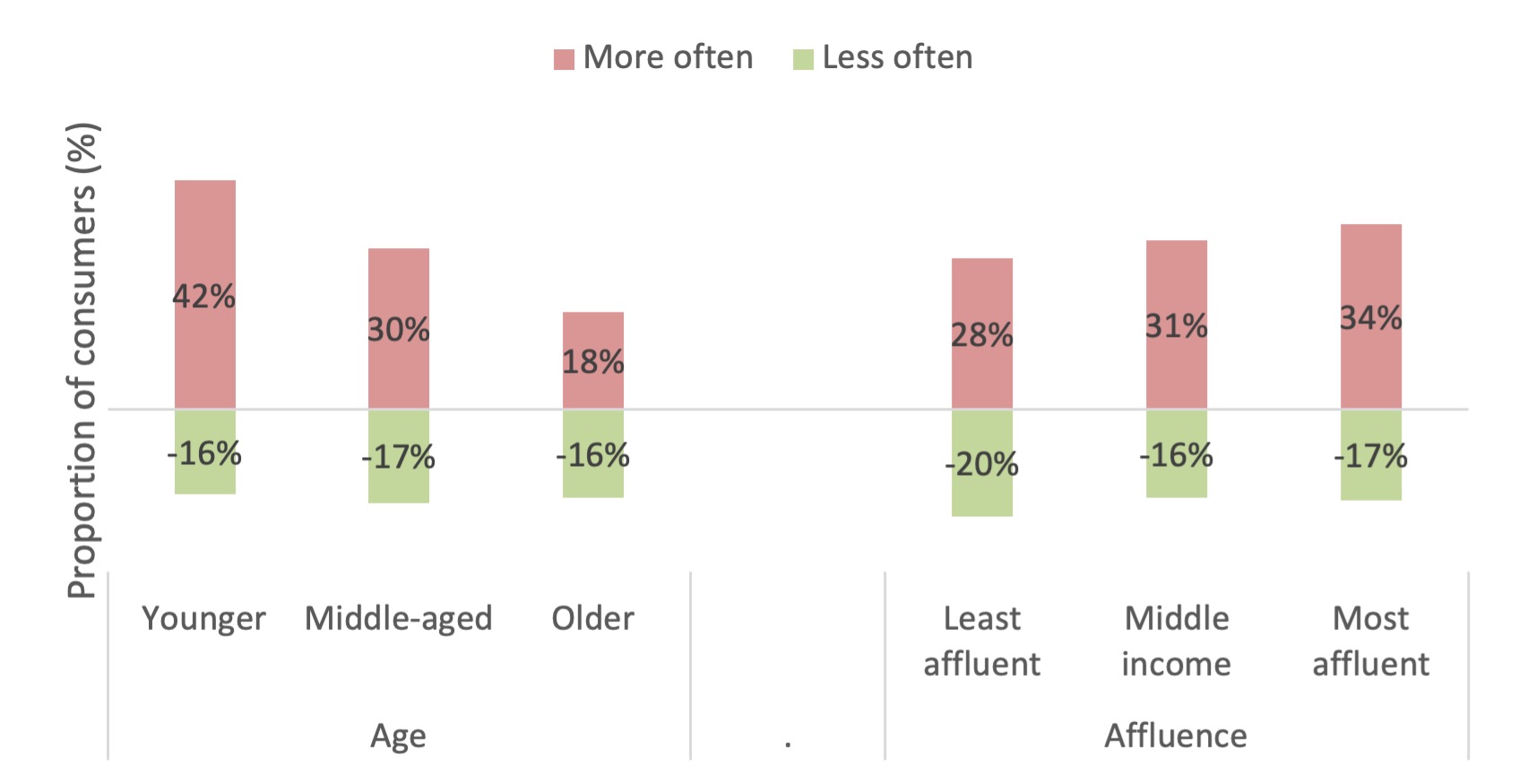

Basket abandonment is increasingly prevalent among younger, middle-aged, and more affluent consumers (see Figure 2). These key demographic groups are showing less tolerance for inflexible delivery options, with their heightened expectations directly impacting retailers’ bottom lines.

Figure 2: Younger and more affluent consumers at increased risk of basket abandonment

- Thinking about your online shopping habits for non-food retail products now compared to last year, how has the frequency of abandoning a shopping basket changed?

Source: Retail Economics, GFS

The rise in basket abandonment to £34.4bn over the last 12 months, up from £31.5bn revealed in the previous year’s research (Figure 1), calls for an urgent revaluation of how retailers manage delivery offerings. Almost two-thirds (62.5%) of 25- to 44-year-olds are demanding delivery choices at checkout to meet their expectations, compelling retailers to refine their delivery strategies to resonate with crucial spenders in a fiercely competitive market with fragile loyalty.

Figure 1: Basket abandonment steps up to £34.4 billion in lost sales due to delivery-related issues

Source: Retail Economics, GFS

Basket abandonment due to delivery-related factors is prevalent across non-food retail categories, with the digitally savvy under-45-year-olds, contributing significantly to the increase in abandonment rates (see Figure 4). For instance, the under-25s are four times (40.6%) more likely to abandon clothing and footwear purchases than the over-65s (10.6%).

Figure 4: Younger shoppers are drivers of greater abandonment across categories

| Abandonment rate (%) | Age group | |||||

| 18-24 | 25-34 | 35-44 | 45-54 | 55-64 | 65+ | |

| Clothing & Footwear | 40.6 | 33.0 | 29.0 | 24.0 | 17.4 | 10.6 |

| Furniture | 35.4 | 31.0 | 27.2 | 25.5 | 15.5 | 12.0 |

| Electricals | 38.6 | 31.6 | 27.2 | 22.5 | 18.0 | 10.9 |

| Health & Beauty | 37.3 | 32.9 | 26.0 | 19.8 | 14.7 | 12.2 |

| Homewares | 35.6 | 31.9 | 27.0 | 21.2 | 16.5 | 11.1 |

| DIY & Gardening | 34.3 | 32.0 | 23.9 | 20.8 | 15.3 | 11.9 |

Source: Retail Economics, GFS

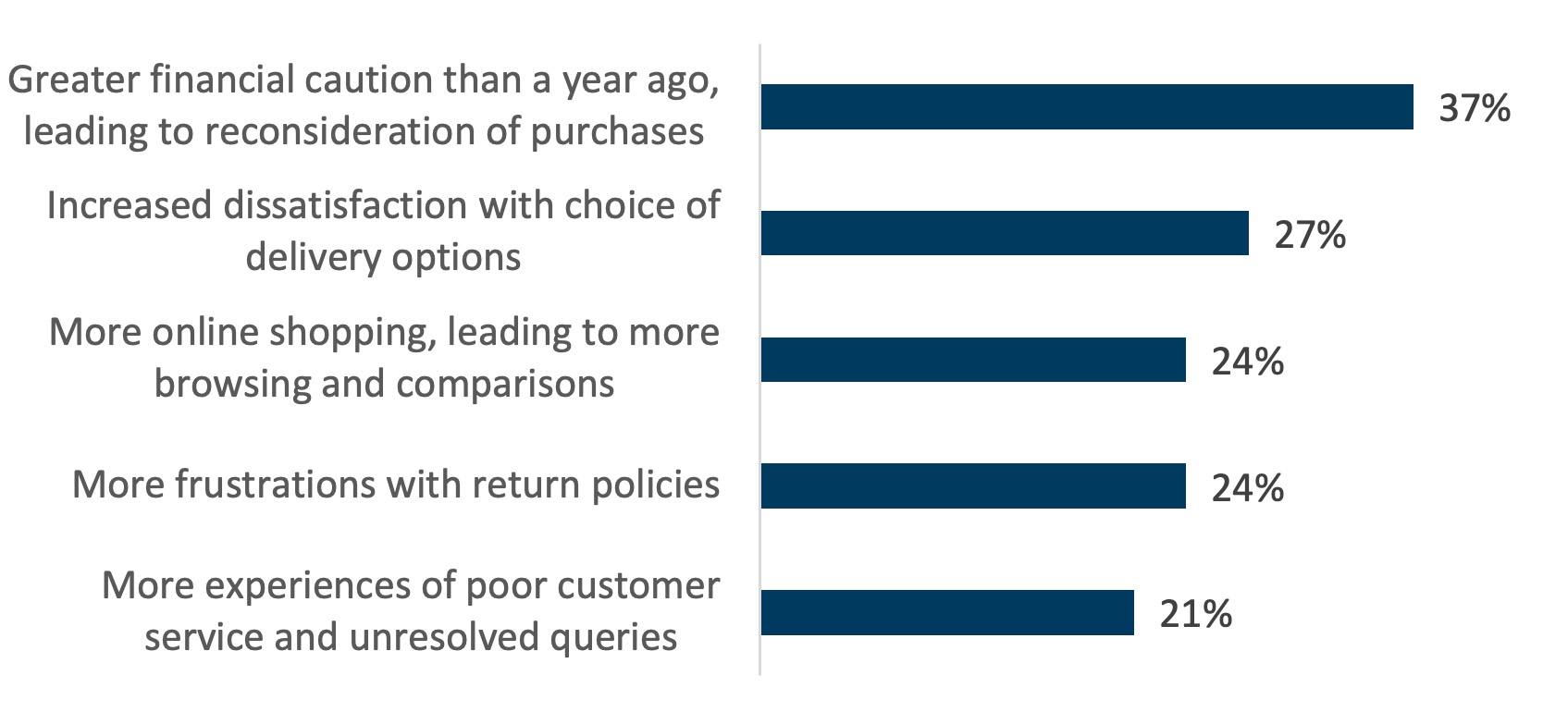

The surge in abandonment can be attributed to amplified caution compared to a year ago. Declining sentiment regarding household finances has disproportionately affected upper- and middle-income groups, who are grappling with increased borrowing costs. Among those earning between £50,000 and £70,000, more than half attribute the rise in abandonment to caution, contrasting with just over a third (37%) in other income brackets (refer to Figure 3).

Figure 3: Cautiousness driven by financial pressures

- Why do you abandon online shopping baskets more often than a year ago? Top five reasons.

Source: Retail Economics, GFS

Heightened consumer expectations and financial pressures are prompting more thoughtful purchase decisions, increasing the risk of basket abandonment. Consequently, consumers are scrutinising service value and options to align with their needs. Almost two-thirds (64.5%) of consumers expect more from retailers’ delivery services than ever before, contributing to 71% of shoppers stopping an online order because of inconvenient delivery times, and 65% because of limited choice of delivery services.

The value consumers place on personalised experiences presents a lucrative opportunity for retailers to capitalise on through premium services. Nearly half (47%) are willing to pay extra for premium options like same-day or next-day delivery. Middle- and high-income under 45s, in particular, are highly inclined to invest in convenient delivery and returns, with over 60% prepared to spend for enhanced shipping services, such as nominated time or express delivery that match their lifestyle and shifting priorities.