Selling internationally to grow your business can feel daunting. As well as handling cross-border delivery, you also have the complicated task of applying the correct duties and taxes. Duties and Taxes are a common logistical concern for businesses with sellers saying it’s their biggest barrier to international growth*.

What are Duties and Taxes?

Sales Taxes are financial obligations paid to the government on sales, and duties are a tax payable to the government on goods and financial transactions. Both of these hike up the price of buying from a seller in another country, but are there to protect companies from foreign competitors and enable the government to control the flow of certain products in and out of the country.

Taxes vary from country to country with different thresholds for when taxes apply to imported items. It’s best to research the tax thresholds for each country you plan to ship to and be able to let your customers know.

How are Duties and Taxes Calculated?

Duties and Taxes are calculated by multiplying the taxable value of the shipment and the tax and duty percentage of the country you are shipping to. Duty percentages do vary depending on the category of goods and taxable value and can change from country to country depending on the valuation method.

Different ways to pay – DDU vs DDP

Duties are taxes are a legal obligation for your buyers. There are two ways they can be paid – DDU and DDP.

DDU shipments are paid on delivery, with customers being contacted by customs when their parcel arrives to settle any charges. This option means that you need to clearly communicate to your customers that the duty will apply to their shipment. Failure to effectively communicate this could lead to an unexpected surprise for customers on delivery, which can reflect badly on your brand.

DDP shipments mean that the sender is responsible for paying the duties. This usually means that they are included in the existing price or added at checkout. This option might make products appear more expensive upfront, but does mean that your customer won’t be contacted for any additional fees and the shipment will be delivered easily.

Communication is Key

Communicating to your customers about Duties and Taxes is important. To boost the customer experience and secure repeat purchases, you need to make sure customers know how and when they will be paying duties and taxes throughout the delivery journey. This should be included on product pages, at the checkout, in your shipping policy and your FAQs. If this is left unclear, you risk cart abandonment, low customer satisfaction, refused deliveries, and more time spent on inbound customer queries.

Making Duties and Taxes Easier

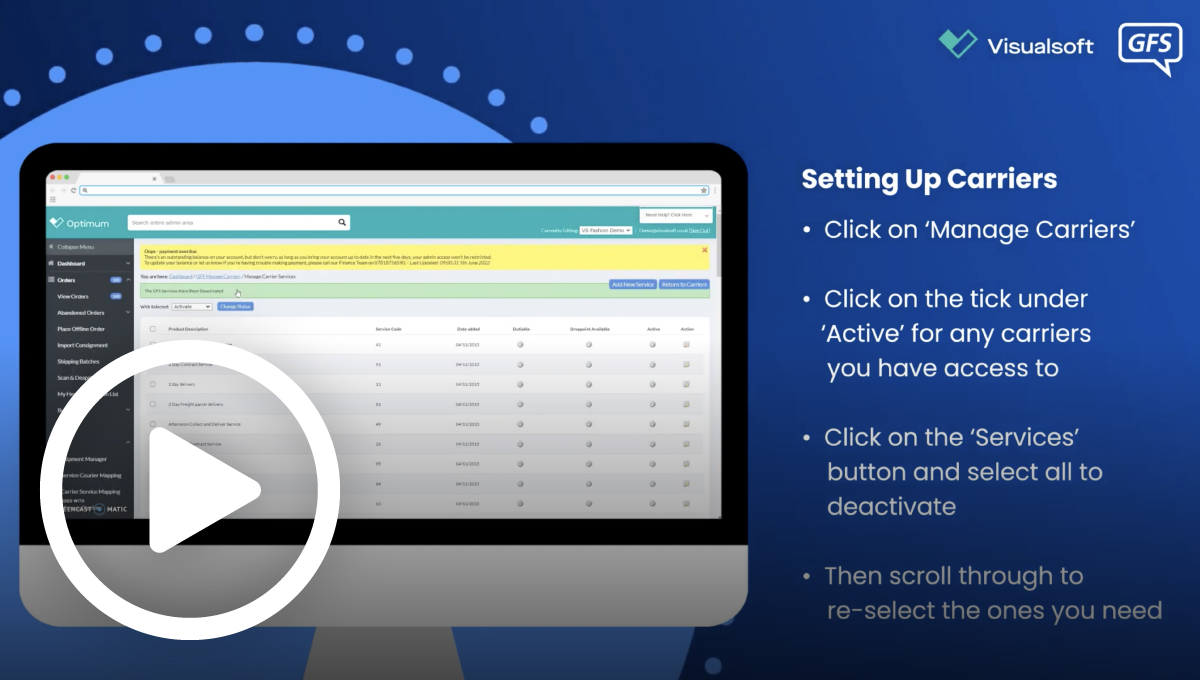

In the modern age, there is more technology available to help online sellers deliver a seamless experience for customers whilst also making their own processes easier. This is also true when it comes to the complicated issue of calculating Duties and Taxes. We have now added a Duties and Taxes calculator to our GFS Checkout software. This provides a simple plugin that presents an array of different delivery options, and calculates the full delivery cost, making cross-border delivery easier than ever! Plus, you can decide if you want to combine Duties and Taxes with the cost of the order or let the customer choose whether they pay now or on delivery.

Find out more by watching our video, or sign up for a demo!